Nissin Corporation (TYO: 9066) is a logistics firm trading at a big discount to book value. Management delivered on their shareholder returns plan and purchased 27% of float in the past year. Cash and liquid marketable securities account for 70% of current market cap.

Stock Price: 4210 JPY

Market Cap: 60.8B JPY (420MM USD)

PB: 0.71x

PE (NTM): 5.90x

ROE (NTM): 12.1%

I find Nissin attractive at current level despite the 70% run-up year to date, due the understated value of its assets as a result of Japanese accounting rules. Management’s shareholder returns plan is a major catalyst to realizing the intrinsic value of the business, as is recent boom in Japanese logistics market that makes Nissin a potential acquisition target.

My estimate of intrinsic value is around 9000 JPY. Until market prices the business accordingly, I am happy to let management grow profit and return capital to shareholder. This reminds me of a young Warren Buffett’s profitable investment in Union Street Railway, a cigar butt with solid shareholder returns. Thanks to Altay Capital for highlighting this business in their recent write-up.

Note: I own shares of this company. This is not investment advice. Please do your own research and understand the risks of stock investing.

Primary sources:

Investor presentation (English)

Repurchase notice & completion

Background

Nissin started in 1938 and went public on Tokyo Stock Exchange’s First Section in 1950. In the post-war decades Nissin expanded across Japan and then the world. Revenue is split 60/40 between Japan and rest of the world, primarily Southeast Asia, USA, and China.

As with many Japanese companies, Nissin’s management team is full of “lifers”. Six executives worked for almost 200 years combined at the firm. CEO Masahiro Tsutsui has been at Nissin since 1986 and became company president in 2008.

Management collectively owns 0.15MM shares (1% of float) in the company. The company also recently granted restricted stock to insiders. Management’s stake in the company is currently worth over 630MM JPY (4.3MM USD). In addition to creating shareholder value, maintaining the company’s legacy is also important to the executives, seen in their compliance to Tokyo Stock Exchange’s new capital efficiency guidelines to stay in the First Section.

Nissin’s New Strategy Unveiled

Low PB Japanese stocks get a bad rep for good reasons, but Nissin is a different case following the reveal of its new medium-term plan.

Financial Targets. The company outlined the following targets for FY 2024 back in 2022: 190B in revenue, 8.5B in operating income, 6.5B in net profit, and 8% ROE. Actual 2024 results were 170B, 8.1B, 8.6B, and 9.7% respectively. The company did not reach the revenue target due to weakness in the macro environment but achieved bottom line target via prudent capital allocation.

Management has set the following targets for FY 2027: 220B in revenue, 11B in operating income, 9.8B in net profit, and 10% ROE. Management has three years to grow revenue by 16% and improve operating income another 30%. This is an ambitious plan, but my thesis is not based on meeting growth targets, so this is more of a bonus.

Capex Plan. The 40B JPY capital expenditure plan includes 20B in four Japan facilities, 15B in overseas investments, and 5B in IT upgrades. In FY 2024, the company spent 8.4B JPY in capex, mostly to complete two facilities. Management expects 50-60B JPY in operating cashflow between FY 2023 and FY 2027 to fund growth capex. So far Nissin generated 31B of OCF in the first two years.

Shareholder Returns. In 2023 management initiated a shareholder return strategy, which included minimum 2% dividend-on-equity yield, 5B reduction in cross-shareholding, and 10B JPY in stock buyback. The goal was to improve PBR to 1x and above. FY 2024 book value was 5,068 JPY per share and the stock was trading around 0.6x PB on the day of FY 2024 earnings release. Management recently raised the targets to 4% DOE yield, 14B JPY in buyback, and an additional 12B in cross-shareholding reduction.

Balance Sheet Analysis

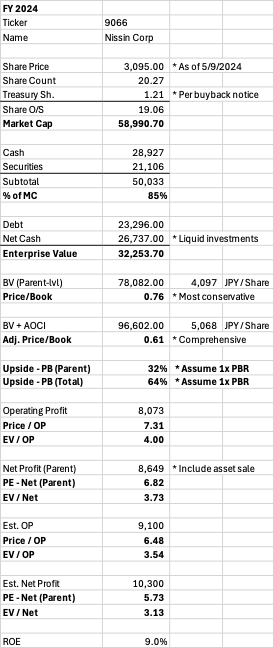

Nissin has a strong balance sheet next to its 59B JPY market cap (FY 2024): 28.9B in cash, 21.1B in investments, 23.3B debt, 26.7B in net cash, and 96.6B in equity including AOCI.

Debt. Short-term debt interest rate was 1.04%-1.21% and long-term debt interest rate was 0.98% (pg. 116 of annual report). Interests and dividends more than offset interest expenses.

Investments. I was surprised to see a 9B JPY in investment gains, which is 15% of the company market cap. The top six investments account for 73% of Nissin’s investments (pg. 61 of annual report), which Nissin can liquidate for 15-16B JPY:

Banks: MUFG (TYO: 8306) at 4B, Concordia Financial (TYO: 7186) at 3B, and SMFG (TYO: 8316) at 0.7B.

Trading Firms: Mitsubishi Corporation (TYO: 8058) at 1.4B, Nissin Shoji (TYO: 7490) at 0.9B.

Honda Motor (TYO: 7267) at 5.4B.

Real Estate Schedule. Many of Nissin’s properties were bought decades ago and carried at cost. PP&E value is massively undervalued at 140B even after adding back 68B in depreciations (pg. 33 of annual report).

For example, a 22k m2 (11.6k m2 in land) warehouse in Daikoku-cho, an industrial area between Yokohama and Kawasaki, has land value of six million yen. Not six hundred or even sixty, but six. I would personally buy that property for $40,000 cash, but of course that’s not what it will sell for today. Nissin’s 30B in land value is clearly undervalued given the scarcity of industrial assets in prime locations. It is worth at least an additional 10-20B JPY.

Macro. 2024 has been a good year for Japanese logistics assets. KKR bought Alps Logistics (TYO: 9055) at a premium. SG Holdings (TYO: 9143) recently snagged Chilled & Frozen Logistics (TYO: 9099) following an intense bidding war. Market sentiment is positive for logistics assets like Nissan as a potential M&A target.

Clean Up Share Structure

According to the annual report, the top ten shareholders own 45% of total float (19.06MM shares), with non-affiliates at 33%.

Banks: Bank of Yokohama (5.1%), Mitsubishi UFJ (4.6%), Sumitomo Mitsui (3.4%)

Insurance: Nippon Life Insurance (3.9%), Sompo (2.2%)

Trust: Master Trust Bank (9.5%), Custody Bank of Japan (4.2%),

Affiliates: Nissin Shoji (4.7%), Nissin Employees (4.5%), Nissin Customers (3%)

MUFG, Bank of Yokohama (Concordia), and SMFG are also lenders with 12.4B JPY in balance (pg. 20 of Japanese proxy). Together they own 13% of Nissin’s stock. Their relationship with Nissin as lender, shareholder, and investee means they are the primary targets for Financial Services Agency to go after in terms of untangling cross-shareholding.

According to the annual proxy, the company has reduced cross-shareholding by 0.53B, 1.17B, and 8B JPY from FY 2022 to FY 2024. The goal is to reduce an addition 12B by FY 2027. The company recently reduced another 8B of investment securities.

Monster Buyback

Whenever I see a company buying back 10% of its market cap in one year, my head perks up. At 20% or higher, I feel like Vince McMahon with laser eyes. Buying back one-fifth of the business is a big decision always worth a closer look.

Based on the earnings release, Nissin spent 2B JPY in FY 2024 to repurchase 4% of float, or 0.79MM shares. Average purchase price was 2,518 JPY per share, which is accretive to shareholders given over 5000 JPY in book value. Note: I use 17.9MM as existing share per buyback announcement, which includes a new employee stock program.

The company announced on May 10, 2024 that it bought back 4.5MM shares for 13.93B JPY, a whopping 23.6% of float. Average cost is 3,095 per share, again at an attractive level. Management already reached their 14B 2027 buyback target. Given Nissin did the buyback via TosNet-3, I’m guessing some big shareholders sold to the company, reducing the cross-shareholding. The company financed the buyback with 13.5B in short-term debt (pg. 115 of annual report) at low rates. There is no concern of repayment as the company currently has 11B in net cash.

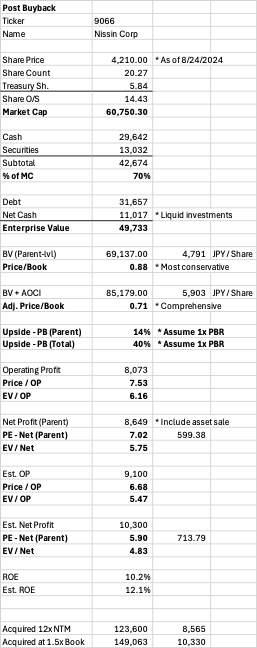

So far, the company has bought back 5.71MM shares (1.21 existing and 4.5 additional), ~28% of total shares. This will boost per share value by 40%. The new float is 14.43MM shares.

Valuation

The stock was very cheap on the day of earnings release in May 2024. Cash and investments made up 85% of market cap. The 0.61x PB indicates 64% upside if the stock re-rates to 1x PB. The business was trading at less than 4x PE excluding net cash (3x NTM PE). Not adjusting for cash position, it was trading at 6.82x PE and 5.73x NTM PE, cheap even for a cyclical business.

Following the buyback announcement ROE improved from 9% to an estimated 12%. As management gradually returns excess cash to shareholders, I estimate that ROE will approach 15%.

Yet at the current level, cash and investments still account for 70% of market cap. Nissin can buy back another 20-30% of its current float. I will give management brownie points if they take low-cost debt to further return capital to shareholders. (I assume future free cashflow can cover capital expenditure and dividends, and any remaining balance is to pay down debt.)

I feel more comfortable buying at the current price because I have much higher confidence in management now. They delivered on their promise to shareholder pronto. Nissin is no longer a typical Japanese cigar butt, but a semi-liquidation/M&A play. The massive buyback is the catalyst. Nissin is a good company at a fantastic price with solid management. Activists won’t even bother with this company anymore because management already did everything in that playbook.

Note: I initially wrote this memo in July when the stock was trading in the high-4000s. Following the August correction it is currently around 4200 with a low of 3530 - I wish I had money to buy at 3530!

For illustrative purposes, I calculated another scenario where management buys back another 2.8MM shares at current price, or 20% of current float. It will cost another 12B JPY, which brings the company to slightly below zero net cash. In total the company will buy back 42% of total float, increasing per share value by 72%. Under this scenario, LTM PE decreases to 5.7x, NTM PE decrease to 4.8x, and ROE increases to 17%. Actual PE and enterprise value adjusted PE will gradually converge as intended. Even then, the company will sell for less than book until investors re-rate this company higher given greater visibility on earnings power. The more stock the company buys back with prudent balance sheet management, the more we can focus on PE as a gauge of valuation.

If a third-party comes along (for example private equity), they should pay 12x NTM earnings or more on a fair value basis, which is still cheap given the 9% implied cap rate for logistics assets (which trades below 5% in the US). That translates to ~9000 JPY per share or 2x current price. I will still likely hold my position at that price, because 12x is “fair value” and there is potential for a multi-round revision up of offer prices during the due diligence period. We also know that management will not attempt a MBO given their recent decision.

I think the company is worth at least 1.50x PB (over 10000 JPY) due to how understated the land value is. It would be wise for management to order appraisals for their properties, so they can accurately gauge liquidation value and realize it themselves. In any case, this company should be worth materially more than 60B JPY (~400MM USD) at present.

Nissin’s Financial Profile Pre-Buyback:

Nissin’s Financial Profile Post-Buyback:

Nissin’s Financial Profile Pending Further Buyback:

Great post!